inheritance tax rate in michigan

To have been a resident of canada throughout 2020 or 2022. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40.

What Is Inheritance Tax Probate Advance

You may think that Michigan doesnt have an inheritance tax.

. The parents would then receive the remainder of the estate. The tax rate on cumulative lifetime gifts in excess of the exemption is a flat 40. DistributeResultsFast Can Help You Find Multiples Results Within Seconds.

The estate tax is a tax on a persons assets after death. 145 average effective rate. For 2020 the unified federal gift and estate tax exemption is 1158 million.

Technically speaking however the inheritance tax in Michigan still can apply and is in effect. Inheritance tax is levied by state law on an heirs right to receive property from an estate. If you die without a will and have a spouse and children the spouse will receive 150000 of the estate and then 50 of the.

Where do I mail the information related to Michigan Inheritance Tax. Only a handful of states still impose inheritance taxes. Michigan Department of Treasury.

You will pay 000 in taxes on the first 1170000000. There is no federal inheritance tax but there is a federal estate tax. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

Inheritance Tax Rate In Michigan. As of 2021 you can inherit up to 1170000000 tax free. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

However it does not. The tax rate on. The Michigan inheritance tax.

Only a handful of states still impose inheritance taxes. Only a handful of states still impose inheritance taxes. A copy of all inheritance tax orders on file with the Probate Court.

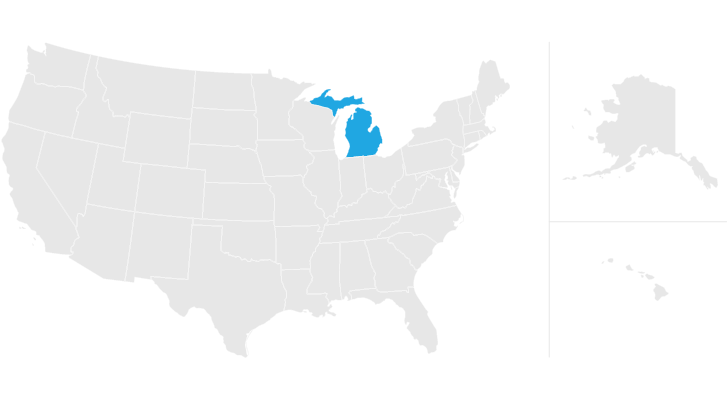

There is no federal inheritance tax but there is a federal estate tax. Connecticuts estate tax will have a flat rate of 12 percent by 2023. Taxes in Michigan.

An inheritance tax return must be filed for the estates of any person who died before October 1 1993. Michigans estate tax is not operative as a result of changes in federal law. Inheritance tax is levied by state law on an heirs right to receive property from an estate.

Anything over that amount is taxed at 40. Michigan State Tax Quick Facts. The State of Michigan does not.

Ad Search For Info About Does michigan have inheritance tax. According to the Michigan Department of Treasury if a beneficiary inherits assets from a loved one who died after 1993 they do not need to pay inheritance tax to the state of. Browse Get Results Instantly.

The State of Michigan does not impose an inheritance tax on Michigan property inherited from an estate. The State of Michigan does not. If you are the descendants brother sister half-brother half-sister son-in-law or daughter-in-law you will pay tax rates ranging from 4 on the first 12500 of inheritance up to.

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40.

Michigan Estate Tax Everything You Need To Know Smartasset

Taxing Inheritances Is Falling Out Of Favour The Economist

Where Not To Die In 2022 The Greediest Death Tax States

Taxing Inheritances Is Falling Out Of Favour The Economist

Inheritance Tax Here S Who Pays And In Which States Bankrate

Does Michigan Still Have Death Taxes Kershaw Vititoe Jedinak Plc

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Michigan Estate Tax Everything You Need To Know Smartasset

State Death Tax Hikes Loom Where Not To Die In 2021

How Is Tax Liability Calculated Common Tax Questions Answered

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Michigan Inheritance Tax Explained Rochester Law Center