how to become a tax accountant uk

Or you can work towards a degree apprenticeship as an accountancy or. Being a Tax Accountant may analyze tax regulations to ensure all regulations are met by organization.

Top 10 Accounting Skills You Need Bright Network

How to become a tax adviser.

. Analytical and data interpretation skills. Get an Association of Chartered Certified Accountants ACCA Certification. Applications for the programme close 2355 on 26 October 2022.

Do your own taxes starting with the first year you earn income to help learn the process from the ground upo Relevant Fact 2. To create an agent services account you must first register with HMRC as a tax agent. Here are the steps youll need to take if you plan on becoming an accountant in the UK.

To become a tax accountant you typically need at least an undergraduate degree in one of the following fields. Specialist courses run by. Working towards this role.

If you want to register for Gambling Tax you do not need an agent code or. Key skills needed to become a chartered accountant include. Application and on-line tests.

Tax accountants who take courses in. Steps to becoming a tax accountant typically include. Study the right accounting qualifications.

You can get into this job through. Additionally Tax Accountant typically reports to. You do not need to be an accounting business or finance major.

Tax Accountants London Are Specialized Tax Handlers Who. While degrees arent always required most accountants have a bachelors in accounting or finance. How to become a tax accountant.

First youll need to obtain a bachelors degree in accounting or a closely related field. The AAT qualification is typically the minimum level. You can become a chartered accountant by taking a degree followed by professional qualifications.

This program helps you develop a solid knowledge of the accounting industry fostering skills like. If you already have a HMRC online services account and have at least one authorised. Get an Entry-Level Position as a Tax Accountant.

CPA education requirements include a four-year bachelors degree and 150 total credits. Begin the process of becoming a tax accountant by pursuing a bachelors degree. Earn a Bachelors Degree.

The deadline for completing all 3 online tests is 1130am on 28 October. Choose a major like accounting. Tax Accountant Tips o Relevant Fact 1.

To become an accountant one must complete a bachelors or masters degree in accounting or related subjects with maths as a compulsory subject. How to become a tax accountant. Use your agent code or reference number to enrol the tax service you want to use onto your account.

In most states earning a bachelors degree is a prerequisite for earning CPA licensure. To work as a tax accountant you can obtain an Association of Taxation Technicians ATT qualification while a prestigious Chartered Institute of Taxations CTA. Once youve acquired a Bachelors Degree in Accounting or a related field youll typically begin your career as an entry-level Tax Accountant.

May require a bachelors degree. To become a successful ACCA professional you must clear 13 professional examinations and.

Tax Accountant Job Description Lhh

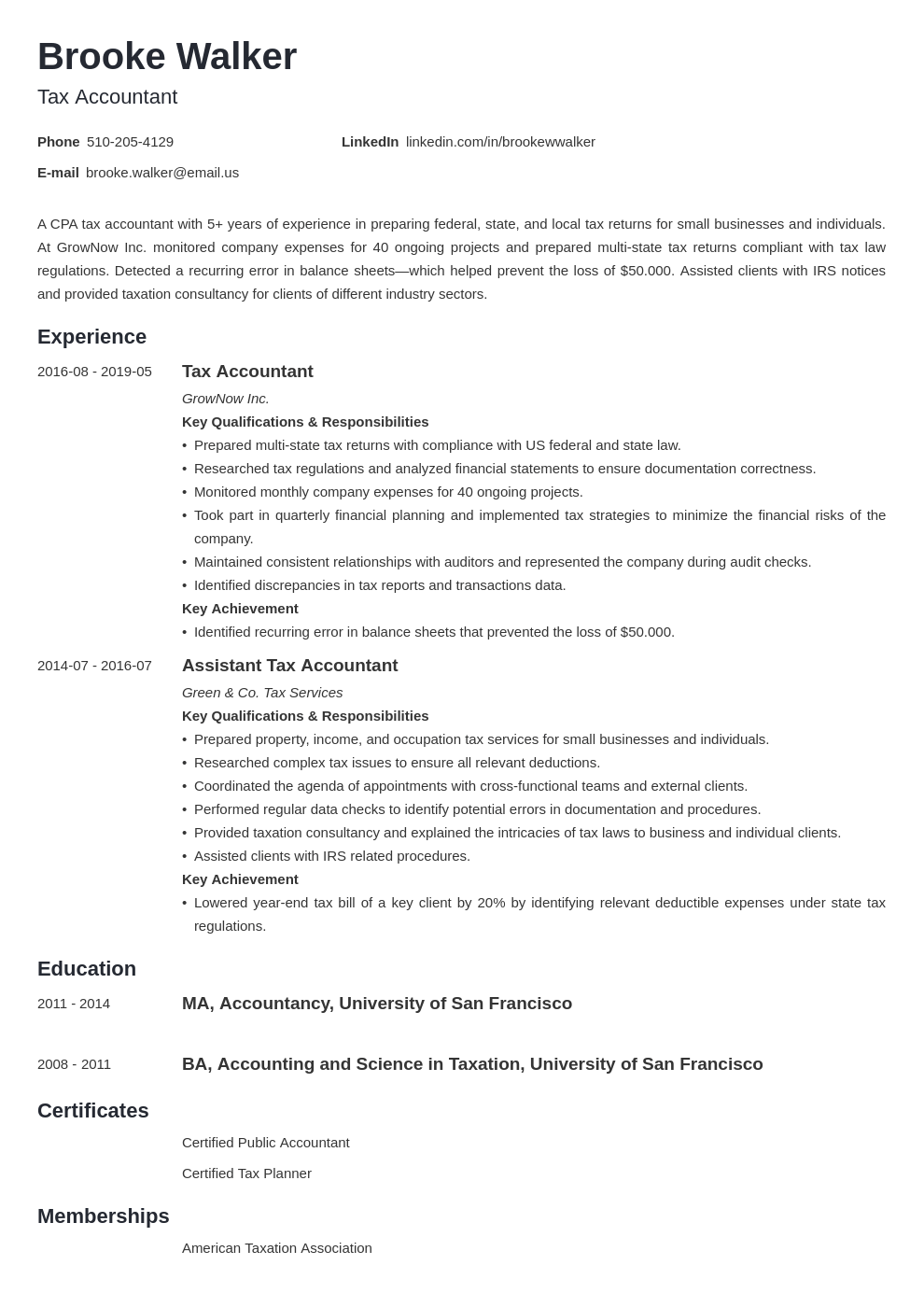

Tax Accountant Resume Sample Guide 20 Tips

Different Types Of Accounting Qualifications Explained 2021 Sllick

Accounting Vs Finance Which Should You Study Top Universities

10 Different Types Of Accountants And What They Do

Wolters Kluwer Tax Accounting Uk Wolters Kluwer

Tax Accountant Job Description Template Workable

What Is A Tax Advisor Skills Qualifications And Getting Started Coursera

Tax Services Accounting Finance Cover Letter Examples Kickresume

Tax Senior Accountant Resume Samples Velvet Jobs

What Is A Tax Accountant Top Accounting Degrees

When You Should Hire A Cpa Or Tax Pro Reviews By Wirecutter

Tax Accountant Uk Personal Tax Accountant Nearby Tax Advisor

A Day In The Life Of An Accountant Indeed Youtube

How To Become A Tax Accountant Your 2022 Guide Coursera

Inclusive Recruiting New Accountancy Opportunity Lonza Group Is Looking For A Senior Technical Accountant To Provide Support Primarily On The Preparation Of The Statutory Accounts Local Legal Requirements And Tax Compliance

How To Become A Tax Accountant Your 2022 Guide Coursera